As the U.S. container market experiences an uptick in prices and the potential for trade tariffs and regulatory shifts looms with the possibility of Trump's re-election, the container market dynamics are in flux, especially against the backdrop of a sustained decline in Chinese container prices. This evolving landscape presents container traders with a strategic window to capitalize on current market conditions and to keep a keen eye on the market trends projected for 2025, thereby optimizing their profit potential.

Amid market volatility, container traders have at their disposal a spectrum of strategies designed to bolster their earnings. Among these, the "buy-transfer-sell" model stands out as a particularly potent approach. This strategy hinges on leveraging the price discrepancies across various markets: procuring containers from markets where prices are lower, generating revenue through container rentals, and then capitalizing on high-demand areas to offload these assets for a profit.

In our upcoming monthly report, we will delve into the intricacies of the "buy-transfer-sell" model, dissecting its critical components such as the acquisition cost of containers, rental fees, and resale values. Furthermore, we will examine the utility of the Axel Container Price Sentiment Index (xCPSI) as a decision-making tool, guiding traders in making the most strategic and data-informed choices in this dynamic industry.

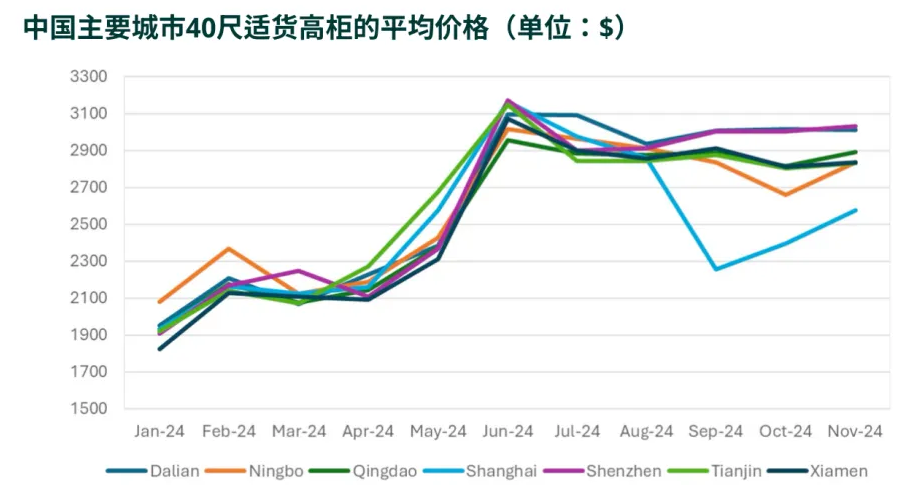

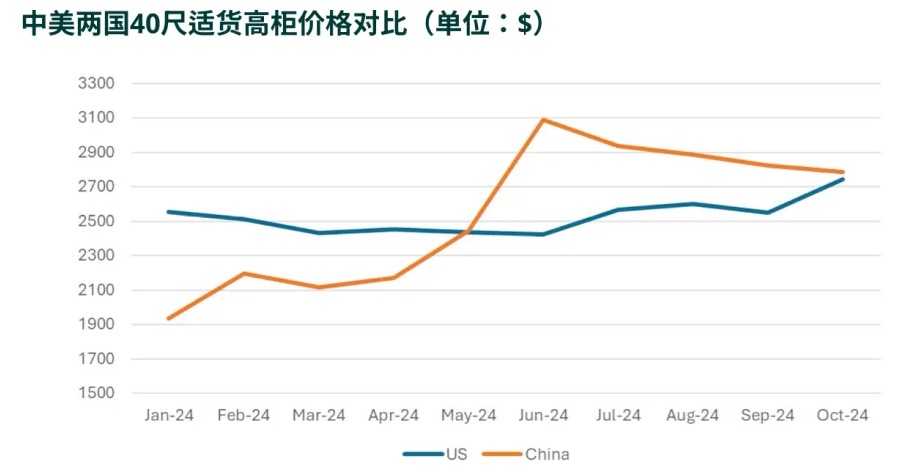

China and US container price trends

Since the peak of 40-foot high cabinet prices in June this year, prices in the Chinese market have shown a continuous downward trend. Traders who want to buy containers in China should seize the current opportunity.

In contrast, container prices in the United States have continued to rise since September this year, mainly driven by geopolitical factors and domestic economic growth. In addition, the Axel US Container Price Sentiment Index reflects the market's optimism and increased uncertainty, and price increases may continue until 2025

US SOC container fees stabilize

In June 2024, the SOC container fees (fees paid by container users to container owners) on the China-US route reached their peak and then gradually fell back. Affected by this, the profit of the "buy container-transfer-sell container" business model has declined. Data shows that the current rental fee has stabilized.

Summary of the current market situation

Over the past few months, the relentless downward trend in Standard Operating Container (SOC) fees rendered the "acquire-container-resell-container" approach unfeasible in terms of profitability during August. However, with the recent stabilization of these fees, container traders are now presented with a ripe opportunity to capitalize on the market.

In essence, traders who opt to purchase containers in China and subsequently transfer and sell them in the United States stand to gain a substantial profit, given the current market conditions.

Enhancing this strategy's allure is the consideration of price forecasts for the forthcoming 2-3 months, which is the approximate transit time for a container's journey from China to the US. By aligning with these projections, the strategy's potential for success escalates considerably.

The proposed strategy is to invest in containers now, dispatch them to the US, and then sell them at prevailing market rates after 2-3 months. While this approach is inherently speculative and fraught with risk, it holds the promise of substantial profit margins. For it to be successful, container traders must possess a deep understanding of market price expectations, supported by robust data.

In this context, the A-SJ Container Price Sentiment Index emerges as an invaluable tool, offering traders the insights necessary to make well-informed decisions and navigate the complexities of the container market with confidence.

Market Outlook 2025: Market Volatility and Opportunities

With the arrival of the seasonal peak, container demand in the United States is expected to increase. Container traders such as HYSUN should plan ahead and purchase or maintain inventory to prepare for future price increases. In particular, traders need to pay special attention to the period leading up to the 2025 Spring Festival, which coincides with Trump's inauguration and the implementation of tariff policies.

Geopolitical uncertainties, such as the US election and the situation in the Middle East, will continue to affect global shipping demand and, in turn, US container prices. HYSUN needs to pay close attention to these dynamics so that it can adjust its strategy in a timely manner.

In terms of paying attention to domestic container prices, traders may encounter more favorable purchasing conditions if container prices in China stabilize. However, changes in demand may also bring new challenges. HYSUN should use its expertise and market insights to grasp market trends and make informed decisions. Through this comprehensive analysis, HYSUN can better predict market movements and optimize its container purchase and sales strategies to maximize profits.